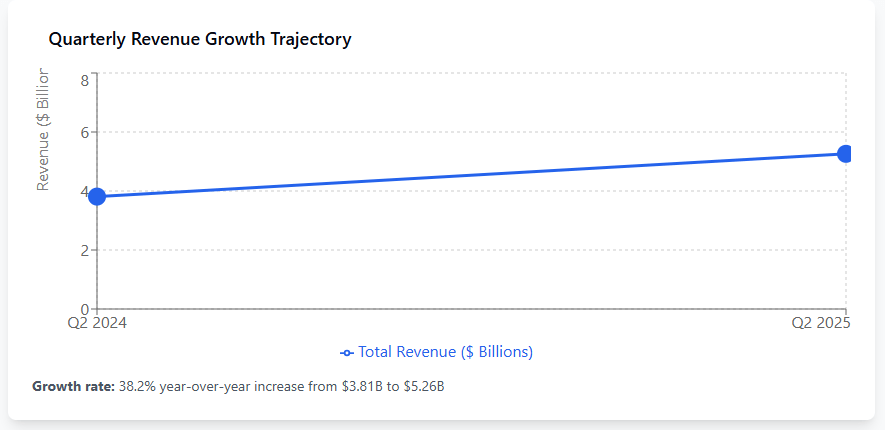

Sea Limited's second quarter 2025 results demonstrate sustained momentum across its three core businesses, with total revenue reaching $5.26 billion—a 38.2% year-on-year increase. For APAC investors tracking the region's digital economy, these numbers reflect broader trends in e-commerce adoption, fintech expansion, and mobile gaming resilience.

Understanding Sea's Business Model

Singapore-based Sea Limited operates three distinct but interconnected platforms: Shopee (e-commerce marketplace), Garena (digital entertainment and gaming), and Monee (digital financial services). The company's reach spans Southeast Asia, Taiwan, and Latin America, making its quarterly performance a bellwether for digital consumer behavior across these high-growth markets.

Q2 2025 Financial Highlights

Group Performance:

Total revenue: $5.26 billion (up 38.2% YoY)

Net income: $414.2 million vs $79.9 million in Q2 2024

Adjusted EBITDA: $829.2 million vs $448.5 million in Q2 2024

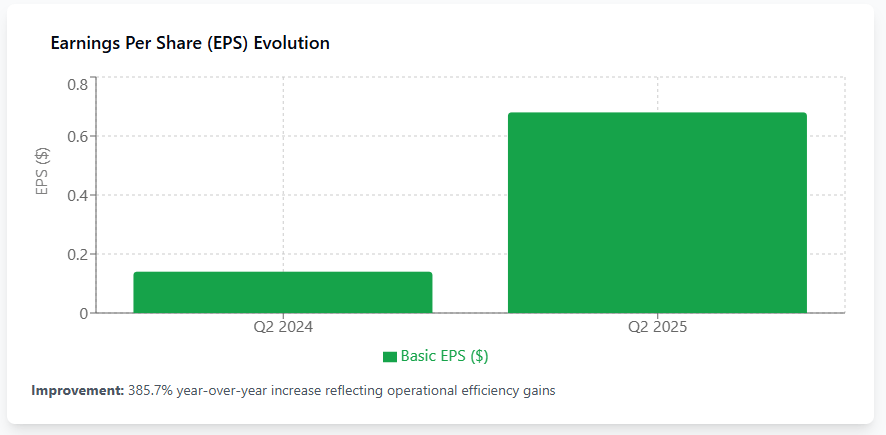

Basic earnings per share: $0.68 vs $0.14 in Q2 2024

Segment Breakdown:

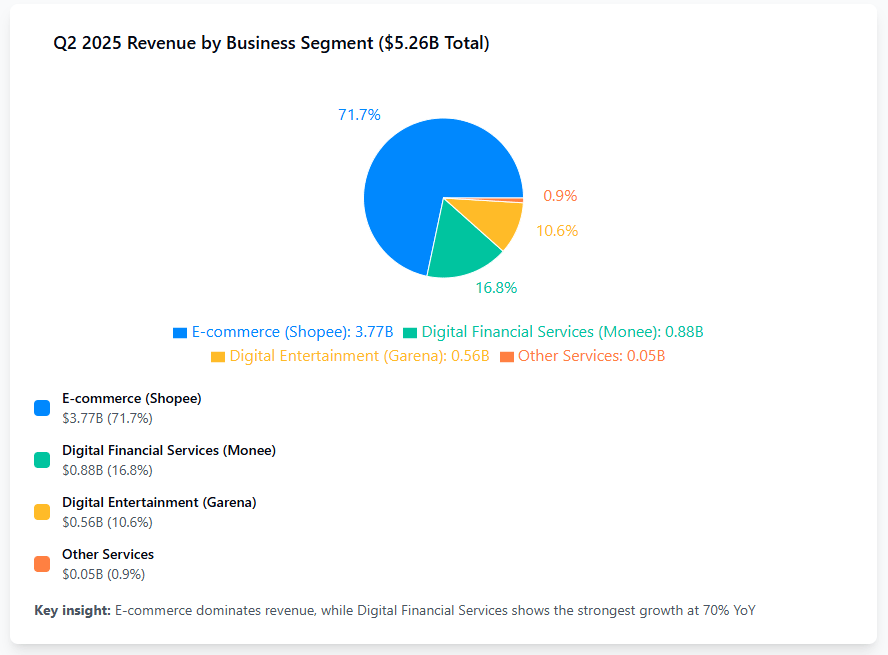

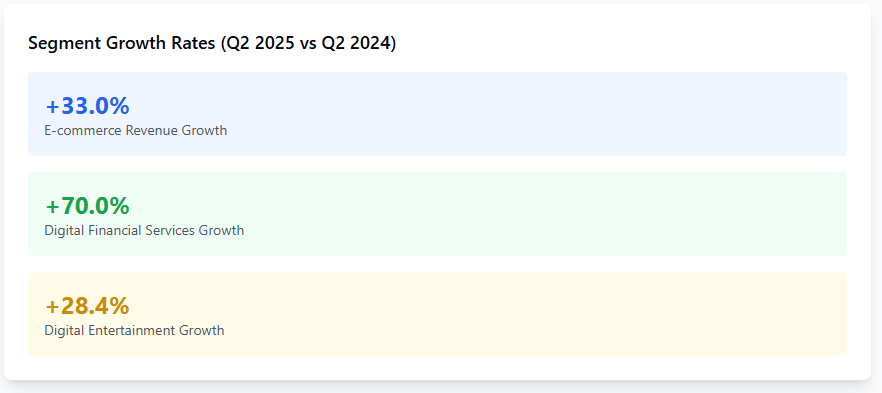

E-commerce: $3.77 billion total revenue (up 33.0% YoY)

Digital Financial Services: $882.8 million (up 70.0% YoY)

Digital Entertainment: $559.1 million (up 28.4% YoY)

Shopee: E-commerce Engine Maintains Momentum

Shopee's Q2 performance reflects the platform's ability to balance growth with profitability improvements:

Key Metrics:

Gross merchandise value (GMV): $29.8 billion, up 28.2% YoY

Gross orders: 3.3 billion, up 28.6% YoY

Adjusted EBITDA turned positive at $227.7 million vs negative $9.2 million in Q2 2024

Brazil Expansion: Shopee's Brazilian operations crossed a significant milestone, with management highlighting the platform's achievement of market leadership by order volume while maintaining profitability. Monthly active buyers in Brazil grew over 30% year-on-year, demonstrating the platform's ability to scale efficiently in competitive international markets.

Monetization Progress: The platform improved its revenue generation through enhanced advertising tools. Core marketplace revenue, primarily from transaction fees and advertising, increased 46.2% year-on-year to $2.6 billion. The advertising take rate improved by nearly 0.7 percentage points, while seller adoption of ad products increased approximately 20%.

Monee: Financial Services Scaling Rapidly

Sea's financial services arm delivered the strongest growth among the three segments:

Lending Portfolio:

Outstanding loan principal: $6.9 billion (up 94.0% YoY)

Active consumer and SME borrowers: Over 30 million (up 45% YoY)

Non-performing loan ratio (NPL90+): 1.0%, stable quarter-on-quarter

Geographic Expansion: Malaysia became Monee's third "billion-dollar market" after Indonesia and Thailand, with its loan book surpassing $1 billion. The expansion demonstrates Sea's ability to replicate its financial services model across different regulatory environments.

Product Integration: SPayLater, Monee's buy-now-pay-later product integrated with Shopee, now accounts for a "mid-teens" percentage of gross merchandise value across markets. Off-platform lending also gained traction, with Malaysia's off-Shopee loans growing over 40% quarter-on-quarter.

Garena: Gaming Business Shows Resilience

Despite a maturing mobile gaming market, Garena maintained strong performance:

Financial Performance:

Bookings: $661.3 million (up 23.2% YoY)

Adjusted EBITDA: $368.2 million (up 21.6% YoY)

Quarterly paying users: 61.8 million (up 17.8% YoY)

Content Strategy: Free Fire's eighth anniversary celebration featured the launch of the "Solara" map, which management described as the game's best-performing launch. Strategic partnerships with Netflix's Squid Game and Naruto Shippuden expanded the game's cultural relevance and user engagement.

Based on Q2 momentum, management raised full-year guidance for Garena bookings, now expecting growth of more than 30% for 2025.

Financial Health and Capital Allocation

Sea's balance sheet reflects a company transitioning from growth-focused spending to sustainable profitability:

Cash and cash equivalents: $2.17 billion as of June 30, 2025

Total assets: $25.44 billion

The company repurchased $233 million in convertible notes during the first half of 2025

Operating cash flow reached $2.37 billion for the six-month period, demonstrating the company's ability to generate substantial cash from operations while funding growth initiatives.

Management Outlook

CEO Forrest Li emphasized the company's dual focus on growth and profitability improvement: "Given the high potential of our markets and the stage we are at in our business now, we will continue to prioritize growth, which will pave the way for us to maximize our long-term profitability."

The company's guidance suggests confidence across all segments, with particular optimism about Garena's full-year performance and continued momentum in Shopee's GMV growth into Q3.

Market Context for APAC Investors

Sea's Q2 results reflect several important trends for regional investors:

Digital Commerce Maturation: Shopee's ability to maintain high growth rates while improving profitability suggests the Southeast Asian e-commerce market is reaching optimal scale efficiency.

Fintech Penetration: Monee's rapid loan book growth indicates significant untapped demand for digital financial services across Sea's markets.

Content Resilience: Garena's sustained performance demonstrates the durability of well-executed gaming franchises in competitive mobile entertainment markets.

Investment Considerations

Following the earnings release, Sea Limited's shares gained approximately 19% in US trading, reflecting investor confidence in the company's execution across multiple business lines.

Key factors for ongoing monitoring include:

Shopee's ability to maintain GMV growth rates while expanding margins

Monee's credit quality as the loan book scales rapidly

Garena's capacity to sustain user engagement amid increased gaming competition

Macroeconomic conditions in key markets affecting consumer spending

Disclaimer: This analysis is for informational purposes only and should not be considered investment advice. Always conduct your own research and consider your risk tolerance before making investment decisions.